WHAT

ARE MUTUAL FUNDS?

A mutual fund is a pool of

money managed by a professional Fund Manager.

It is a trust that collects

money from a number of investors who share a common investment objective and

invests the same in equities, bonds, money market instruments and/or other

securities. And the income / gains generated from this collective investment is

distributed proportionately amongst the investors after deducting applicable

expenses and levies, by calculating a scheme’s “Net Asset Value” or NAV. Simply

put, the money pooled in by a large number of investors is what makes up a

Mutual Fund.

Here’s a simple way to

understand the concept of a Mutual Fund Unit.

Let’s say that there is a box of 12 chocolates costing ₹40. Four friends decide to buy the same, but they have only ₹10 each and the shopkeeper only sells by the box. So the friends then decide to pool in ₹10 each and buy the box of 12 chocolates. Now based on their contribution, they each receive 3 chocolates or 3 units, if equated with Mutual Funds.

And how do you calculate the cost of one unit? Simply divide the total amount with the total number of chocolates: 40/12 = 3.33.

So if you were to multiply the number of units (3) with the cost per unit (3.33), you get the initial investment of ₹10.

Let’s say that there is a box of 12 chocolates costing ₹40. Four friends decide to buy the same, but they have only ₹10 each and the shopkeeper only sells by the box. So the friends then decide to pool in ₹10 each and buy the box of 12 chocolates. Now based on their contribution, they each receive 3 chocolates or 3 units, if equated with Mutual Funds.

And how do you calculate the cost of one unit? Simply divide the total amount with the total number of chocolates: 40/12 = 3.33.

So if you were to multiply the number of units (3) with the cost per unit (3.33), you get the initial investment of ₹10.

This results in each friend

being a unit holder in the box of chocolates that is collectively owned by all

of them, with each person being a part owner of the box.

Next, let us understand

what is “Net Asset Value” or NAV. Just like an equity share has a traded price,

a mutual fund unit has Net Asset Value per Unit. The NAV is the combined market

value of the shares, bonds and securities held by a fund on any

particular day (as reduced by permitted expenses and charges). NAV per

Unit represents the market value of all the Units in a mutual fund scheme on a

given day, net of all expenses and liabilities plus income accrued, divided by

the outstanding number of Units in the scheme.

Mutual funds are ideal for

investors who either lack large sums for investment, or for those who neither

have the inclination nor the time to research the market, yet want to grow their

wealth. The money collected in mutual funds is invested by professional fund

managers in line with the scheme’s stated objective. In return, the fund house

charges a small fee which is deducted from the investment. The fees charged by

mutual funds are regulated and are subject to certain limits specified by the

Securities and Exchange Board of India (SEBI).

India has one of the

highest savings rate globally. This penchant for wealth creation makes it

necessary for Indian investors to look beyond the traditionally favoured bank

FDs and gold towards mutual funds. However, lack of awareness has made mutual

funds a less preferred investment avenue.

Mutual funds offer multiple

product choices for investment across the financial spectrum. As investment

goals vary – post-retirement expenses, money for children’s education or

marriage, house purchase, etc. – the products required to achieve these goals

vary too. The Indian mutual fund industry offers a plethora of schemes and

caters to all types of investor needs.

Mutual funds offer an

excellent avenue for retail investors to participate and benefit from the

uptrends in capital markets. While investing in mutual funds can be beneficial,

selecting the right fund can be challenging. Hence, investors should do proper

due diligence of the fund and take into consideration the risk-return trade-off

and time horizon or consult a professional investment adviser. Further, in

order to reap maximum benefit from mutual fund investments, it is important for

investors to diversify across different categories of funds such as equity,

debt and gold.

While investors of all

categories can invest in securities market on their own, a mutual fund is a

better choice for the only reason that all benefits come in a package.

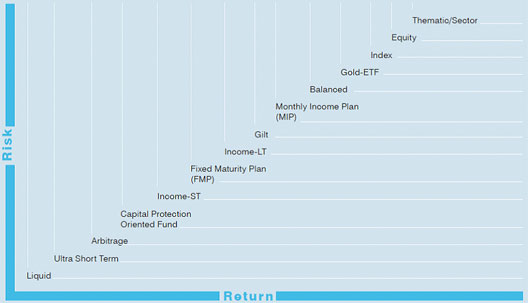

A PLETHORA OF SCHEMES TO CHOOSE FROM

Mutual funds are favoured

globally for the variety of investment options they offer. There is something

for every profile and preference.

Chart 1: Risk/Return

trade-off by mutual fund category

TYPE OF MUTUAL FUND SCHEMES

Mutual Fund schemes could

be ‘open ended’ or close-ended’ and actively managed or passively managed.

OPEN-ENDED AND CLOSED-END

FUNDS

An open-end fund is a

mutual fund scheme that is available for subscription and redemption on every

business throughout the year, (akin to a savings bank account, wherein one may

deposit and withdraw money every day). An open ended scheme is perpetual and

does not have any maturity date.

A closed-end fund is open for

subscription only during the initial offer period and has a specified tenor and

fixed maturity date (akin to a fixed term deposit). Units of Closed-end funds

can be redeemed only on maturity (i.e., pre-mature redemption is not

permitted). Hence, the Units of a closed-end fund are compulsorily listed on a

stock exchange after the new fund offer, and are traded on the stock exchange

just like other stocks, so that investors seeking to exit the scheme before

maturity may sell their Units on the exchange.

ACTIVELY MANAGED AND

PASSIVELY MANAGED FUNDS

An actively managed fund is

a mutual fund scheme in which the fund manager “actively” manages the portfolio

and continuously monitors the fund's portfolio , deciding on which stocks to

buy/sell/hold and when, using his professional judgement, backed by analytical

research. In an active fund, the fund manager’s aim is to generate maximum

returns and out-perform the scheme’s bench mark.

A passively managed fund,

by contrast, simply follows a market index, i.e., in a passive fund , the fund

manager remains inactive or passive inasmuch as, she does not use her judgement

or discretion to decide as to which stocks to buy/sell/hold , but simply

replicates / tracks the scheme’s benchmark index in exactly the same proportion.

Examples of Index funds are an Index Fund and all Exchange Traded Funds. In a

passive fund, the fund manager’s task is to simply replicate the scheme’s

benchmark index i.e., generate the same returns as the index, and not to

out-perform the scheme’s bench mark.